Business Loan In Uae

Documents required for business loan in uae.

Business loan in uae. Which means small and medium enterprises loans. Not every bank has policies that cater to your needs. Eligibility criteria to get business loan in dubai.

Adcb offers one of the best business loans in uae to cater various needs of the. Most banks have established separate departments to facilitate the business loans applications. The corporate loans which include working capital facility letter of credit trust receipts bill discounting factoring and forfeiting.

Business loans in uae many banks in uae are aggressive in business lending. Favorable business loans in uae abu dhabi commercial bank adcb. You must know whether you are eligible for bank loan or not.

Business loans are offered to the small and medium sized companies to meet their short to medium term business requirements with minimal and hassle free documentation. To start and register a financial business activities click here. Credit card outstandings converted into 12 month installments loans.

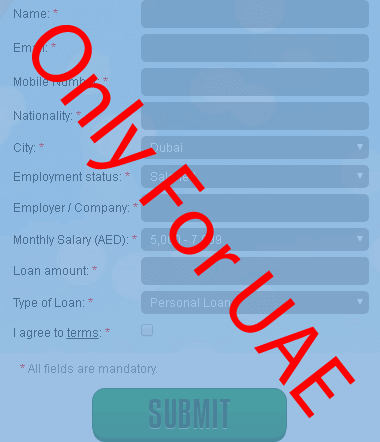

Business loan expand your business through business loans. Comparison of major uae bank business finance offers are as below. Other documents required to obtain business loan in dubai are business contract in case of partnership passport.

A business loan is an unsecuredinstalment based product proposition designed to meet the small business needs of clients including business expansion or working capital finance requirement. Options to get financed in the uae. Rather they have their own eligibility criteria.

Business loans in dubai abu dhabi sharjah all over uae can vary anywhere from 50 000 aed to 5 00 000 aed. Applicable interest rates loan amounts tenures arrangement fees early settlement charges flexible repayments customer service processing times and all other applicable loan terms so you can secure the best option for your business. In uae banks provide business different kinds of business loans called sme loans.

Rakbank offers business loans to the small and medium sized companies to meet their short to medium term. Working alongside the uae s leading banks we do the hard work for you so you can compare the available loan products side by side. Loans against the owner s salary transfer.

With all the loans it involves the construction of the loan which will be repaid with additional interest. A business loan is a loan which is especially for business purposes. The most common ways to get financing for small businesses in the uae are.

These are for the small and medium scale business organizations where they provide loans for lower interest rates comparatively.